Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

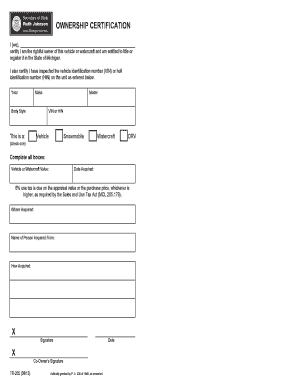

Who is required to file tr 205?

The TR 205 form is required to be filed by all individuals who are self-employed or have income not subject to withholding. This includes income from rental activities, business activities, royalties, capital gains, and other types of income.

What is the purpose of tr 205?

TR 205 is a form used by the Internal Revenue Service (IRS) to report a taxpayer's estimated taxes. It is used to report and pay estimated tax, which is a form of self-assessment tax system used to pay taxes on income that is not subject to withholding, such as income from self-employment, interest, dividends, alimony, rent, gains from the sale of assets, prizes and awards.

When is the deadline to file tr 205 in 2023?

The deadline to file Form TR-205 for the 2023 tax year is April 15, 2024.

TR 205 refers to a technical reference document related to a specific topic. Without further context, it is not possible to determine the exact subject matter of TR 205. It could be related to various fields such as telecommunications, engineering, or any other discipline that uses technical reference documentation.

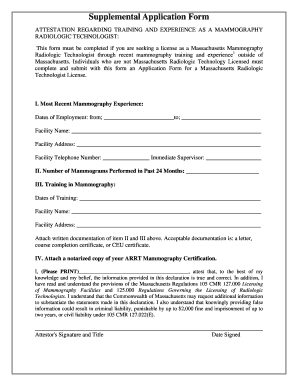

To fill out TR 205 (Traffic Collision Report), follow these steps:

1. Begin by entering the date and time of the accident in the appropriate fields at the top of the form.

2. Provide the location details of the accident, including the street name, nearest intersection, and city or town.

3. Fill in the section titled "Collision Diagram" to visually represent the accident scene. Use the provided symbols to depict the vehicles involved, their direction of travel, and any other relevant features such as road markings or obstacles. Use additional pages if needed.

4. Include the names and contact information of all parties involved in the accident, including drivers, passengers, and pedestrians.

5. Describe each vehicle involved, including make, model, year, license plate number, and owner details.

6. Provide insurance information for each vehicle by including the name of the insurer, policy number, and expiration date.

7. Indicate the contributing factors that were present at the time of the accident, such as excessive speed, weather conditions, road conditions, or driver distraction. Check the appropriate boxes or provide additional details as necessary.

8. Describe each vehicle's movement or action just before the collision occurred.

9. Indicate the point of impact on each vehicle involved using the provided diagrams and describe the initial direction of travel before the collision.

10. Note any injuries sustained by individuals involved in the accident, including passengers and pedestrians. Include details on treatment received or if medical attention was refused.

11. If there were witnesses to the accident, record their names and contact information.

12. Provide any additional information or statements related to the accident in the "Descriptions" section at the end of the form.

13. Sign and date the form once it is complete.

Ensure that all information provided is accurate and legible. It is also advisable to take photographs of the accident scene and any damages for further documentation.

What information must be reported on tr 205?

TR 205 refers to the filer's statement of income and expenses for a bankruptcy case. While specific requirements may vary depending on the jurisdiction and type of bankruptcy, generally, the following information must be reported on TR 205:

1. Personal Identification: The filer must provide their full name, address, social security number, telephone number, and any other relevant personal identification information.

2. Income: The filer must disclose their income from all sources, including employment wages, self-employment income, rental income, pension, retirement benefits, and any other regular or sporadic income received during the defined time period.

3. Expenses: All necessary and reasonable household expenses must be listed, including but not limited to rent/mortgage, utilities, insurance, taxes, groceries, transportation costs, medical expenses, child support, alimony, and any other recurring or essential costs.

4. Debts and Liabilities: The filer must provide details about all debts and liabilities they owe, including credit card balances, medical bills, car loans, student loans, tax debts, and any other outstanding financial obligations.

5. Assets: All assets owned by the filer must be reported, such as real estate, vehicles, bank accounts, investments, retirement accounts, and any other valuable possessions.

6. Other Financial Information: Additional financial information may be required, such as details about any recent transfers of property or assets, pending lawsuits, pending or ongoing support obligations, and any other relevant monetary matters.

It is important to note that the specific requirements and forms to be used may vary depending on the jurisdiction, type of bankruptcy (Chapter 7, Chapter 13, etc.), and the court handling the case. Consulting with a bankruptcy attorney or reviewing the local bankruptcy court's guidelines can provide the most accurate and up-to-date information for TR 205 filing requirements.

What is the penalty for the late filing of tr 205?

The penalty for the late filing of TR 205 can vary depending on the specific circumstances and jurisdiction. TR 205 typically refers to a specific form or document associated with a particular organization or government agency. To determine the exact penalty for late filing, it is advisable to consult the relevant guidelines or regulations provided by the organization or agency responsible for the TR 205 filing. Additionally, seeking professional advice or contacting the organization directly can provide more accurate information regarding potential penalties.

How do I execute tr 205 online?

pdfFiller has made it simple to fill out and eSign tr205 michigan form. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit tr 205 certification of ownership in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your tr205, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I fill out the tr 205 form form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign tr 205 michigan form and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.